Just as human health insurance protects you from sky-high medical bills, pet insurance serves the same purpose. Many insurance companies offer policies for pets - and there are even some insurance companies specifically dedicated to pets. The big question is, is it worth it? The answer is furrier than you may think.

According to The New York Times, in 2017 only an estimated 1 to 2 percent of the nation's dogs were insured. That number has since grown, partially due to large insurance brands like Geico and Nationwide making pet insurance a more prominent option in their portfolio. Canine Journal dubbed Healthy Paws the best insurance plan of 2020, with low premium prices and a highly rated customer service team.

For Fi users with a current pet insurance plan, it’s worth noting that your Fi Collar might already be covered by your plan. Embrace, for example, offers plan options that may include monetary reimbursement for your purchase of a Fi collar.

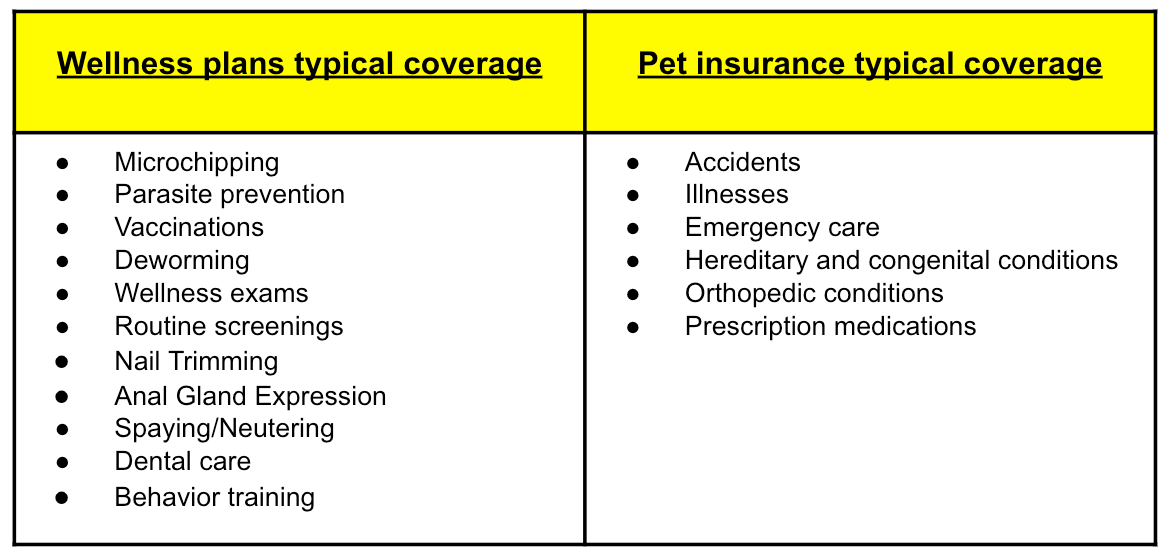

You can’t predict an accident, but your pup’s breed might be a high-risk for hip dysplasia, breathing difficulties, allergies, or other medical issues. Spending on your pet adds up quickly, and in order to be proactive, it’s important to note the difference between a pet wellness plan and pet insurance.

We consulted Dr. Jamie Richardson, Medical Chief of Staff at Small Door Veterinary, on her point of view on pet insurance versus wellness plans. She shared her insight below:

"Knowing that your pet’s vet bills are covered in the event of unexpected illness or injury can provide great peace of mind. Pet insurance is designed to help cover the cost of the unpredictable, and so typically covers (either all or a percentage of) expenses related to injuries or illnesses (often subject to deductibles and maximum yearly claim amounts). It typically does not cover wellness or regular preventative care to keep your pet healthy, such as annual vaccines, exams, wellness bloodwork or other testing, or monthly flea, tick and heartworm preventatives. That’s where you might consider a pet wellness plan in addition to insurance, offered by many vets with a monthly or annual fee to cover all the wellness care your pet will need over the year.

Different pet insurance policies can vary greatly, so it’s important to always read the details thoroughly, research and compare policies before purchasing. A good resource you can utilize is www.pawbamacare.com where you can compare insurance plans to better understand your coverage needs."

The age of your dog also plays a large factor in the cost of pet insurance. At Fi HQ, we’ve got senior dogs and puppies + all ages in between, and less than half of them have pet insurance. One of our new puppy owners says, “I want to know if something happens I can do everything possible to fix it.” For some of our more distinguished pups, the cost of pet insurance skyrockets once they pass the puppy years -- in this case, the cost of insurance may be more expensive than the procedures they might require in their older age.

Dr. Jeff Werber, Fi’s Veterinary Expert, shares his point of view on pet insurance below:

"First and foremost: insurance is something you’ll need the most when you don’t have it. There’s nothing worse than the look on an owner’s face when delivering tough news about a sick dog’s condition, and the often high cost of the treatment if they need it. In the long run, most people will spend more than they save, but the peace of mind is worth it for them. There are a few ways to navigate the pet insurance world, and there are also third party players, like Care Credit, who can front the cost in case of an emergency. Self-insuring is another great alternative for someone who isn’t keen on pet insurance: take a portion of your earnings each month and set it aside in a savings account dedicated to your dog. But if you know you’re not that disciplined, pet insurance might be your best option. "

Fi recommends consulting your personal vet when deciding on a pet insurance plan, as your dog’s medical history and predispositions to certain issues will be major deciding factors. As a dog owner, it’s important to be prepared for the unexpected.